.png)

.png)

SWMCFCU's new Mobile App and Home Banking is here!

You spoke and we listened. We are now simplifying our online and mobile banking into one platform. Our new digital banking experience provides convenience with enhanced security, new features and functionality. We think you will enjoy the convenience of:

-

Single sign-on for online and mobile banking

-

Consistency across all devices

-

Logging in with two-factor authentication

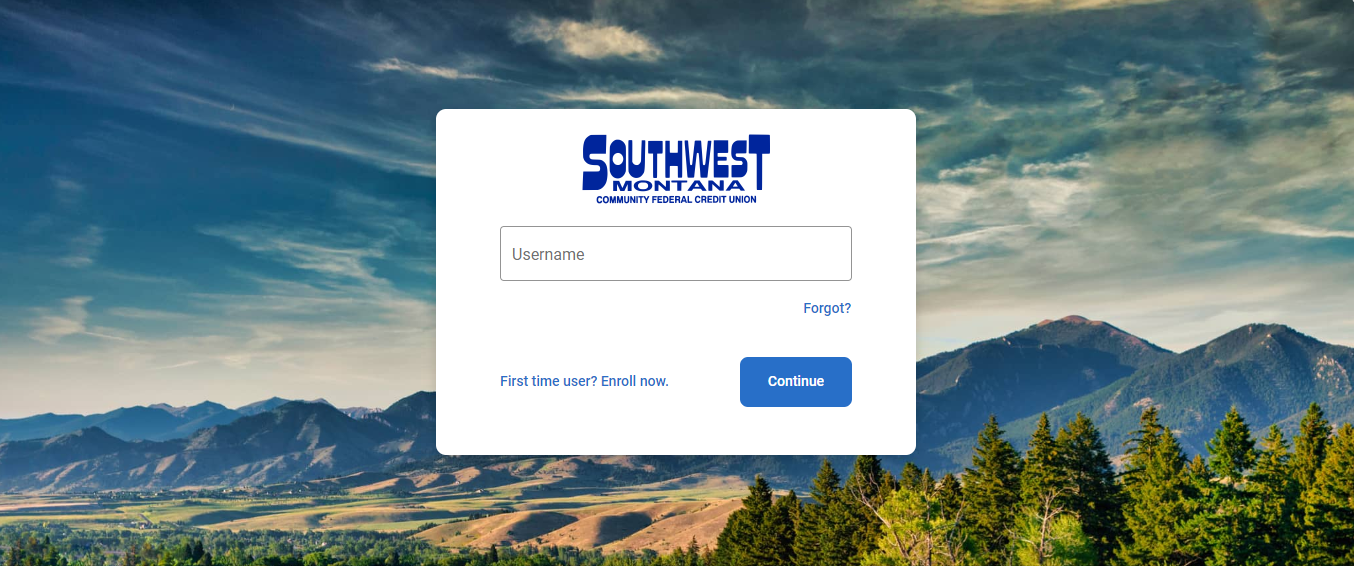

Make sure you know your username and password before 10/31/2023. And have your current mobile number and email address on file with us. If your username and password are saved on your device or desktop, it WILL NOT transfer to the new system. You will need to remember what they are. You can always try the password reset feature if you know your username.

There is no need to enroll in digital banking if you were previously enrolled in on-line banking, your account carried over to our new system as long as your log in ID met the following criteria:

-

Log on ID began with a letter

-

Log on ID did not contain a special character

-

Log on ID did not exceed 20 characters in length

If your log on ID did not meet the above criteria or you were not previously signed up for on-line banking, you will need to go through the enrollment process to enroll.

If you are having trouble logging in, you can click on "Try Another Way" and use the account recovery feature.

New Passwords in this feature need to have a Character. Example: #!@%^&*$

Mobile App users that attempt to log in on Oct. 31st will automatically be asked to update their app. You will not have to go out and get a new app.

Frequently asked questions

What is 2-Factor Authentication and why is it used by the digital banking system?

Two-Factor Authentication is a security measure that allows you to request a one-time access code to log in to digital banking. The code enhances the security by creating an added layer on top of your unique username and password. This security process helps to verify you and better protect your credentials and the accounts you can access.

When I log into digital banking, do I need to get a confirmation code every time I log in?

No. Check the “Don’t ask for codes again on this computer” box if you do not want to receive a confirmation code or phone call each time you log in. If you prefer to input a confirmation code with each use, you can leave the box unchecked or use the 2-Factor Authentication app to deliver the code.

Note: If you ever want to remove a device and reset your security settings, you can change them in settings once logged in to digital banking.

How can I log in to digital banking if I can't get a verification code through text message?

Two-Factor authentication uses a unique one-time access code to verify identity and log on to digital banking. If you are unable to receive text (SMS) messages, you can choose to receive your access code via a phone call.

-

On the verification code screen click Try another way located beneath the Verify button

-

Select Phone Call and click Next

-

You will receive an automated phone call that will provide your access code (Have a pen and paper ready)

-

Return to the verification code screen

-

Enter your access code and click Verify

If you are still having trouble, contact the credit union to ensure we have the correct phone number on file.

Can I use an email for two-factor authentication?

An email and a phone number are required for the two-step authentication. The one-time access code will be sent via text or phone call. The phone number must match our records for the additional security layer to work correctly.

Are my bill payment accounts being transferred automatically or do I need to set them up again in the new digital banking?

Bill payment accounts will be automatically transferred and do not need to be set up again.

Will my scheduled bill payments carry over to the new digital banking?

Any scheduled bills will be paid as scheduled and scheduled payments will carry over to the new digital banking experience.

Will I need to re-enroll in eStatements with the new digital banking?

You will not have to re-enroll in eStatements, however your previous e-Statements will not carry over to our new on-line banking system. If you need copies of previous statements simply give us a call and we will be happy to provide them to you.

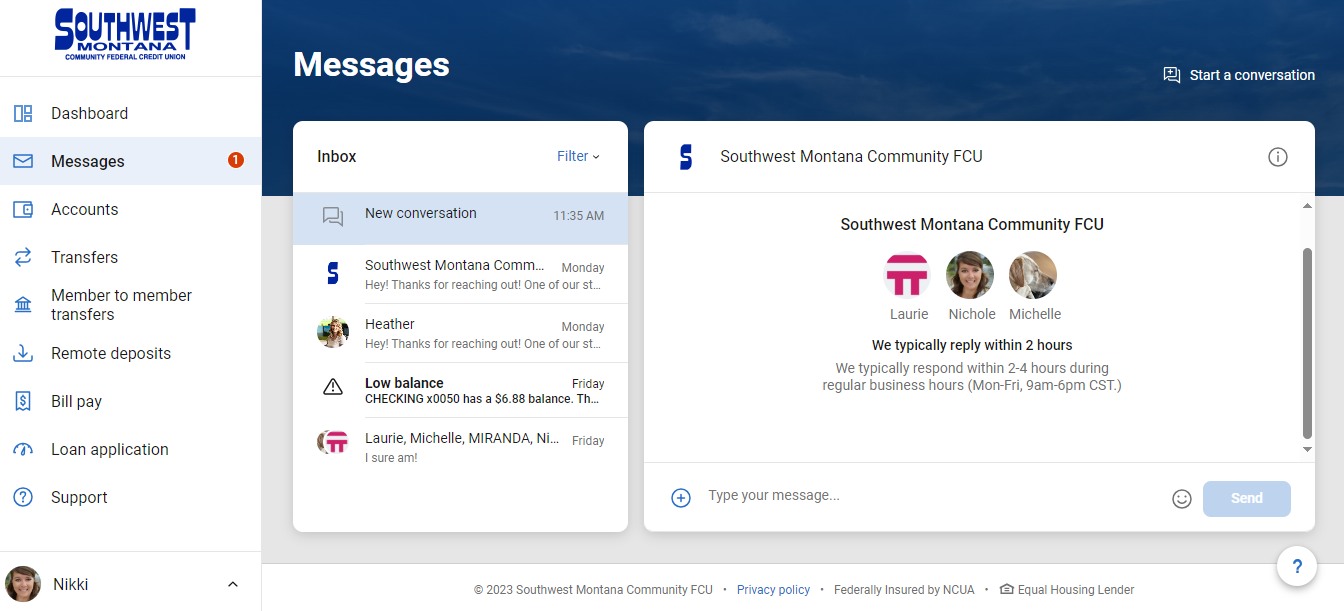

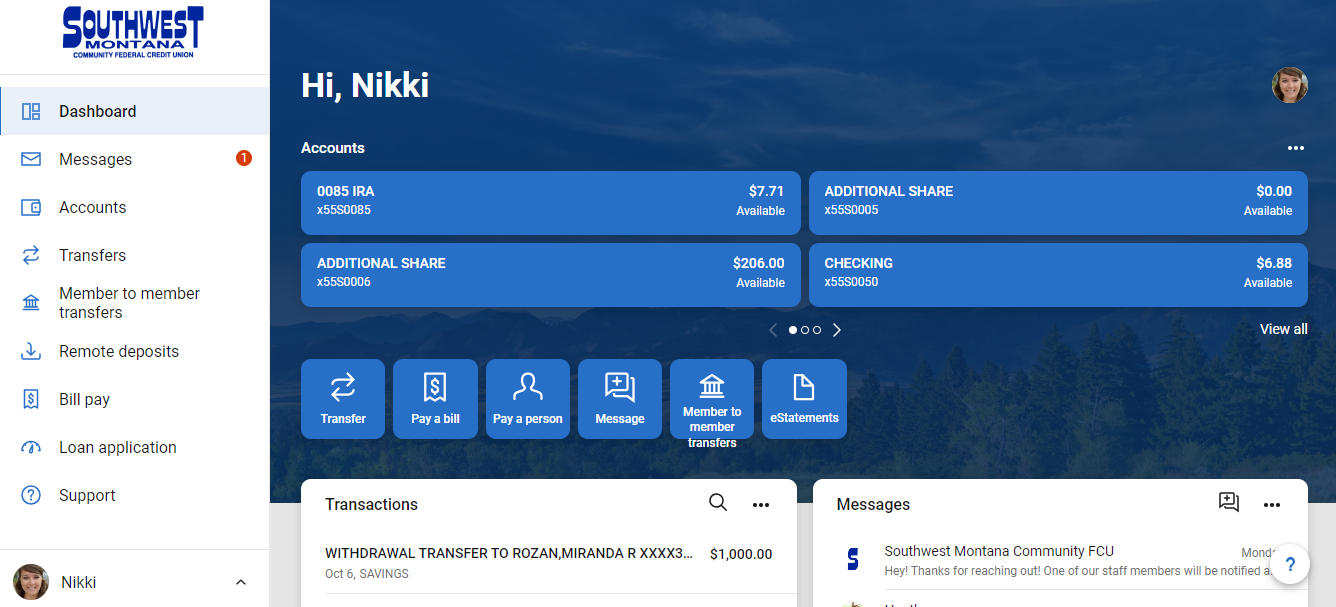

We hope you enjoy some new features! Your dashboard will look fresh and new!

We now offer live conversations.! Chat with several of our staff in real time and pass information back and forth. Please note, it may take us some time to start the conversation, but the new feature works much like text messaging, and we will start a chat session with you as soon as a staff member is available. If you can't stick around, the message will be waiting for you when you log in again.